Main Thoughts

- Fintech has emerged as a powerful force, reshaping industries like banking, payments, investments, insurance, and lending.

- One of the critical challenges faced by the financial industry is the growing threat of cybersecurity breaches and fraud.

- Fintech companies have been at the forefront of adopting advanced security protocols to safeguard sensitive financial data.

- Fintech’s use of artificial intelligence (AI) and machine learning (ML) algorithms has played a significant role in fraud prevention.

- Fintech applications leverage big data analytics to monitor and analyze user behavior.

- Fintech companies often work closely with regulatory bodies, financial institutions, and cybersecurity experts to exchange information and develop best practices.

Introduction

Before going any further, let’s start with the definitions. Fintech is the short for financial technology, and this term describes the use of technology in providing financial services. The term Fintech applications refers to a wide range of technology-powered financial services, products, and applications that disrupt, improve, or even revolutionize traditional financial services delivery.

The benefits that financial applications bring individuals or organizations include but are not limited to, streamlining financial processes, reducing costs, introducing innovative technologies, increasing the efficiency and speed of financial management. Additionally, finance apps are providing more access and customization to financial services.

For example, a Fintech app can provide access to financial services to anyone with a stable internet connection, anytime and anywhere. They can also save time in processing online payments or loan approvals, while offering lower transaction fees and interest rates as compared to other alternatives. Fintech apps are usually tailor-made for specific needs, so you can expect a high level of customization in satisfying your particular needs.

In this article, we will discuss the most popular use cases for Fintech applications. However, keep in mind that in this industry everything is changing fast and there can be groundbreaking solutions right around the corner.

Don't have time to read?

Book a free meeting with our experts to discover how we can help you.

Book a MeetingPayment and Money Transfer Applications

These applications allow individuals to send and receive money electronically, providing a convenient and secure way to transfer money, pay bills, and make online purchases. According to Market Watch, a Dow Jones company, The Digital Money Transfer and Remittances market revenue was worth USD 2256 Million in 2019, and will have reached USD 5597 Million in 2025, with an impressive CAGR of 16.35% during 2020-2025.

The must-have features for this type of application include:

- Robust and up-to-date security capabilities

- User-friendly interface

- Real-time notifications

- Multiple payment options (including debit and credit cards, bank transfers, and mobile wallet payments)

- Integration with other apps (for example personal finance management software)

- Customization of payment preferences

- The possibility to set up recurring payments

- A responsive customer support system

Additionally, there are some interesting features that could be added. For example, the use of Artificial Intelligence for voice and facial recognition for improved security. The app may also have split payments functionality, which allows splitting bills between family members, friends, or roommates. Integrating reward programs or cash-back programs is another interesting feature that can improve the user experience.

As of 2023, the leading payment and money transfer apps include PayPal, Venmo, and Zelle. PayPal is considered to be the easiest to use, and Venmo is the most convenient for shared bills. Zellee works great for bank-to-bank transfers.

There are plenty of other available regional options that are constantly evolving. The honorable mentions are Alipay and WeChat Pay, which are huge in the Chinese market.

Ultimately, these solutions make it easier and more convenient for users to send and receive payments by offering mobile accessibility, multiple payment options, instant transfers, and lower transaction fees, as compared to other methods. While not all of the most popular systems are available globally, the odds are that you will find a suitable solution in your location.

Our Experience

We know how to work with these types of apps due to years of experience working with payment solutions. We have been developing and expanding a marketplace platform for over a decade. Our team has integrated over 20 payment systems into this platform, which opened up some new opportunities for sellers to acquire new clients.

Investment and Wealth Management Applications

These types of apps are on the rise and will become even more popular. According to a survey, Affirm, (42%) of Gen Z have started saving or are planning to start saving by the time they hit 25 years old. As you can see from the name, this software helps individuals manage their investments better and grow their wealth more quickly.

In 2023, users can leverage the following kinds of software that can be considered as investment and wealth management applications:

- Robo-advisors are automated investment management platforms that provide personalized investment advice for users with the help of AI algorithms. Examples of these are Betterment, Wealthfront, and Acorns.

- Stock trading apps are platforms that offer users the functionality to buy and sell stocks via mobile devices with low trading fees and real-time trade. Look up Robinhood or TD Ameritrade.

- Cryptocurrency trading platforms are software that allows users to trade digital currencies with the ability to use advanced analytical tools. Coinbase and Binance will be good examples of this.

The must-have features for this type of application include investment tracking (across various asset classes like stocks, bonds, mutual funds, and exchange-traded funds (ETFs), portfolio management, financial planning, research and analytics tools, automated investing, and tax optimization.

An interesting feature you can add to this type of solution is social investing. This feature allows users to share their insights with other investors to improve investment strategies. Additionally, integration with social media services and other Fintech solutions that can expand the functionality will also be a great idea.

If we talk about investment management, the aforementioned Robinhood, Acorns, Betterment, and Coinbase are the most prominent real-life examples right now.

Probably, the biggest advantage of this type of solution for users is that people who have limited amounts of money can start investing. Compared to the traditional investment methods, these apps are unlocking more investment options with lower fees, helping diversify investments and automate investment decisions with the help of AI.

Our Experience

We have years of experience in developing investment and wealth management applications due to our long-term partnership with Morningstar, Inc., the American financial services firm with an array of different products and services. Our experts provide Dedicated Development Team Services, Custom Software Development, FinTech Software Development Services, AI Solutions Development, Post-release Maintenance, and Support Services to the client and have hands-on experience with different investment-related software products.

Lending and Financing Applications

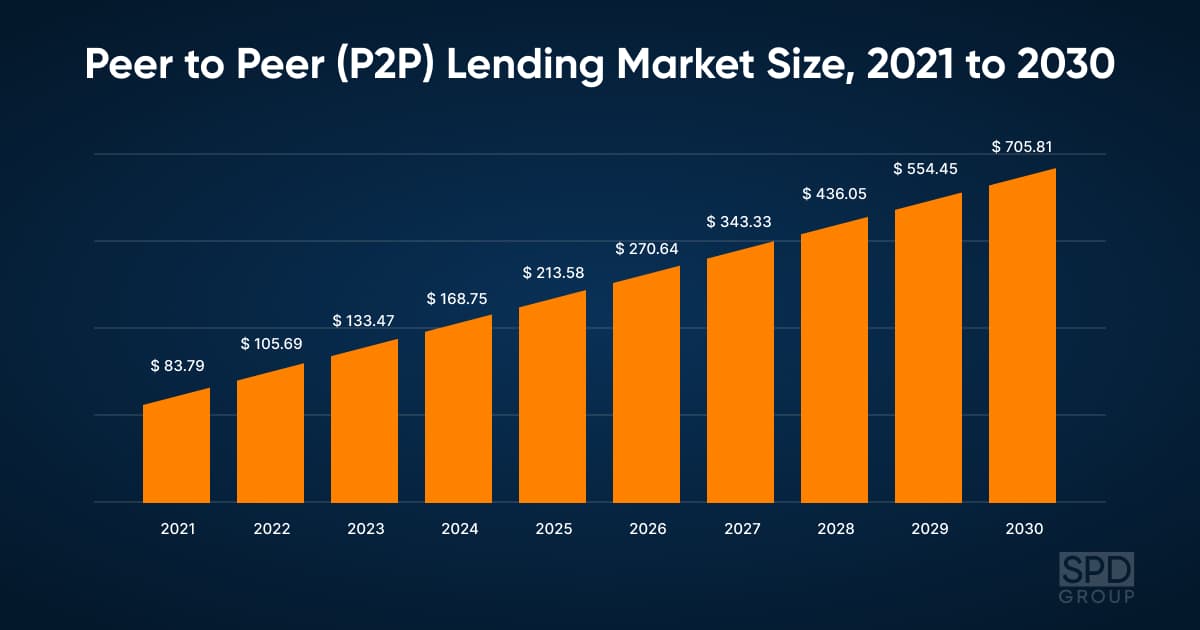

As of the fourth quarter of 2022, Americans owe USD 222 Billion in personal loan debt, according to Lending Tree. This is 31% higher as compared with 2021, so this market is on the rise. Lending and Financing applications are digital platforms that allow borrowers and lenders to connect, and serve as an effective alternative to traditional banks and credit unions.

This type of solution includes:

- Peer-to-peer lending platforms that connect borrowers and lenders directly.

- Online loan marketplaces for borrowers to connect with a network of lenders.

- Crowdfunding platforms that allow borrowers to raise funds from multiple investors.

Additionally, there are invoice financing platforms that allow small business owners to receive cash advances on outstanding invoices and merchant cash advance platforms that offer cash advances to small businesses in exchange for a percentage of their future credit card sales.

Specific must-have features for these apps must include:

- An effective loan or investment matching mechanism with detailed preferences that can be adjusted.

- Complete online application process functionality without the need to conduct any additional actions online.

- Detailed reporting and analytics.

- Robust verification and underwriting mechanisms.

- Secure payment processing and compliance with consumer protection and data privacy regulations.

Some interesting features that can be added include Machine Learning-powered automated underwriting and approval, far quicker than manual underwriting. One can also add integration with popular finance management tools to provide users with more insights.

Among the most popular examples of lending and financing applications are the peer-to-peer lending platforms LendingClub and Prosper that allow borrowers to receive loans of up to $40,000 and $50,000 respectively.

It is also important to mention Kickstarter that has secured one of the top positions among the crowdfunding platforms for over a decade.

The reason why lending apps are becoming more popular is that they provide borrowers with better funding and investment opportunities, while investors and lenders can potentially receive higher returns. Compared to traditional approaches, lending, and financial apps are faster and more flexible. They open more funding opportunities for users like small business owners with limited credit histories.

Our Experience

Currently, our team is working on an innovative Irish property investment platform, with a capability for users to lend to larger projects of between €5m and €12.5m. Users can both invest in Irish property and receive financing on the platform.

Personal Finance Management Applications

This type of Fintech application is all about helping people improve their money management habits, save more, and become wealthy in the future. There are several types of personal finance management apps with different focuses, including:

- Budgeting apps helping to stick to a certain budget

- Expense tracking apps to monitor spending

- Financial education platforms for a better understanding of personal finance

Any personal finance management app should include:

- The function to track and categorize expenses

- A feature to manage spending in different categories

- Financial goal setting

- Bill reminders

- Aggregation of different financial accounts into a single dashboard

- Strong data security (including multi-factor authentication, data encryption and adherence to all the necessary data privacy regulations)

Among some interesting features one can include in these types of apps are goal-based savings, integration with digital assistants like Amazon Alexa or Google Assistant, and gamification elements, like rewards for reaching financial milestones. Additionally, cash flow forecasting that would allow predicting future income and social integration with other accounts are great features to add too.

The top personal finance management apps in 2023 include Quicken for overall planning, Mint for budgeting, and YNAB for habit building.

Probably, the biggest way in which personal finance management applications empower individuals is by providing a holistic view of their financial health, i.e. by displaying their income, expenses, assets, net worth, and liabilities. Based on this information, users can make more informed financial decisions and improve their overall quality of life.

Our Experience

For over 8 years, we’ve been involved in implementing a personal finance management app development project for Mogami. Our experts have developed a progressive web application, being a feature-rich and powerful product. There is an entire case study about this project on our blog, and you can read it here: Developing a Personal Financial Application for a U.S-based Client.

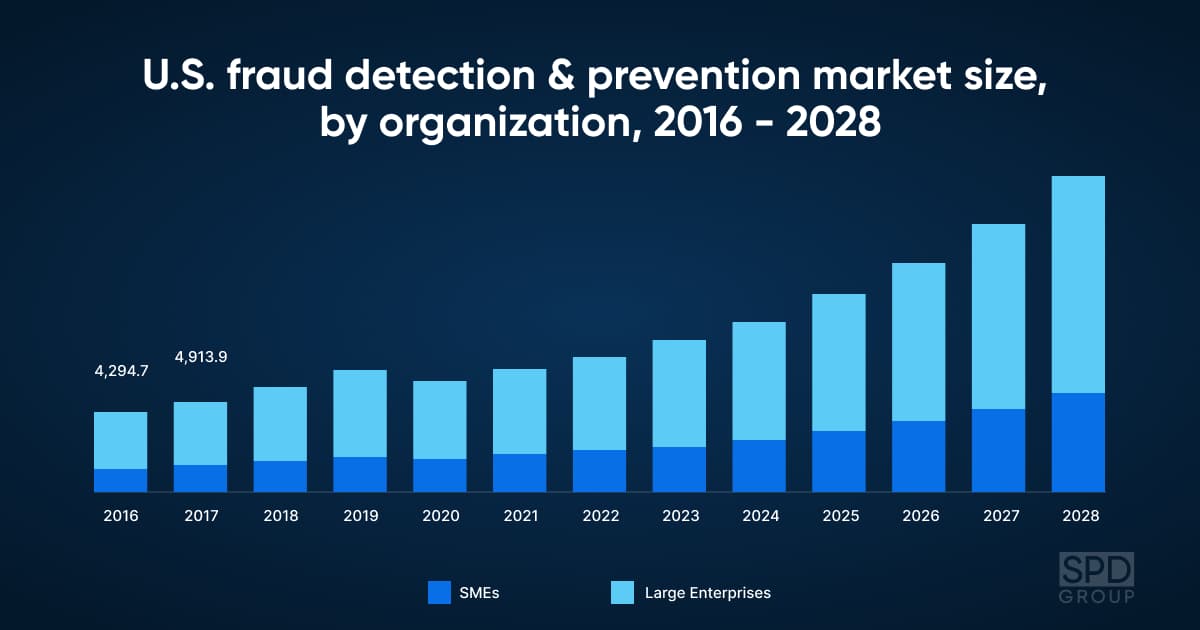

Cybersecurity and Fraud Prevention Applications

This category encompasses a range of tools and technologies that help protect individuals and organizations from cyber threats and fraudulent activities of criminals. The most common apps include identity verification platforms (to prevent identity theft, account takeover, and unauthorized access), anti-fraud software (for analysis of patterns, transactions, and user behavior), and biometric authentication systems (that provide a deeper level of security by analyzing unique biological characteristics).

It is also important to mention encryption tools that ensure that data remains secure during transmission and storage, firewalls, and detection/prevention systems (IDS/IPS) for monitoring network traffic in organizations.

Every modern cybersecurity and fraud detection application should include features like:

- Real-time threat detection with immediate alerts and notifications to security teams.

- Advanced analytics capabilities for large volumes of data.

- Implementation of Machine Learning algorithms.

- Multi-factor authentication (MFA) (including SMS, email, biometric authentication or hardware tokens).

- Password strength analysis, regular security updates, and adherence to latest cybersecurity standards and regulations like PCI DSS, GDPR, or ISO 27001.

Along with the must-have features, there are plenty of other possibilities to improve security levels even further. For example, the incorporation of behavioral biometrics, like keystroke dynamics or mouse movement analysis, and the implementation of geo-fencing capabilities to restrict access based on geographical boundaries.

Some of the popular real-life examples of these applications include Auth0, Kount, and FacePhi. Auth0 is a world-renowned modern identity and access management platform that provides secure authentication and authorization services to users. Kount is one of the top fraud prevention and digital verification platforms with Artificial Intelligence and Machine Learning capabilities. FacePhi is a leader in biometric authentication solutions and specializes in face recognition.

In 2023, cybersecurity and fraud prevention applications play a crucial role in mitigating risks associated with financial transactions. They protect individuals and businesses by maintaining a secure environment for digital interaction and, preventing financial losses, reputational damage, and legal implications, caused by cyber threats and fraud.

Security apps are mandatory in the modern world for any financial institution because cybercriminals are always trying new ways to penetrate systems and steal money, so it is important to be one step ahead.

Our Experience

We have years of experience in implementing finance-related projects and developing and maintaining cybersecurity and fraud prevention apps for our clients.

Our team has developed an entire security platform from scratch. This is a full-blown cybersecurity management solution that has won multiple prestigious cybersecurity awards and has gained strategic partners amongst well-known providers of cybersecurity management solutions. You can find more details about this in Case Study: Vulnerability Management Platform Development.

As for AI Solutions Development, we provide these services to one of our biggest clients PitchBook. We are also involved in a number of smaller projects, to ensure the corresponding solutions’ cybersecurity is up to the highest standards.

Conclusion

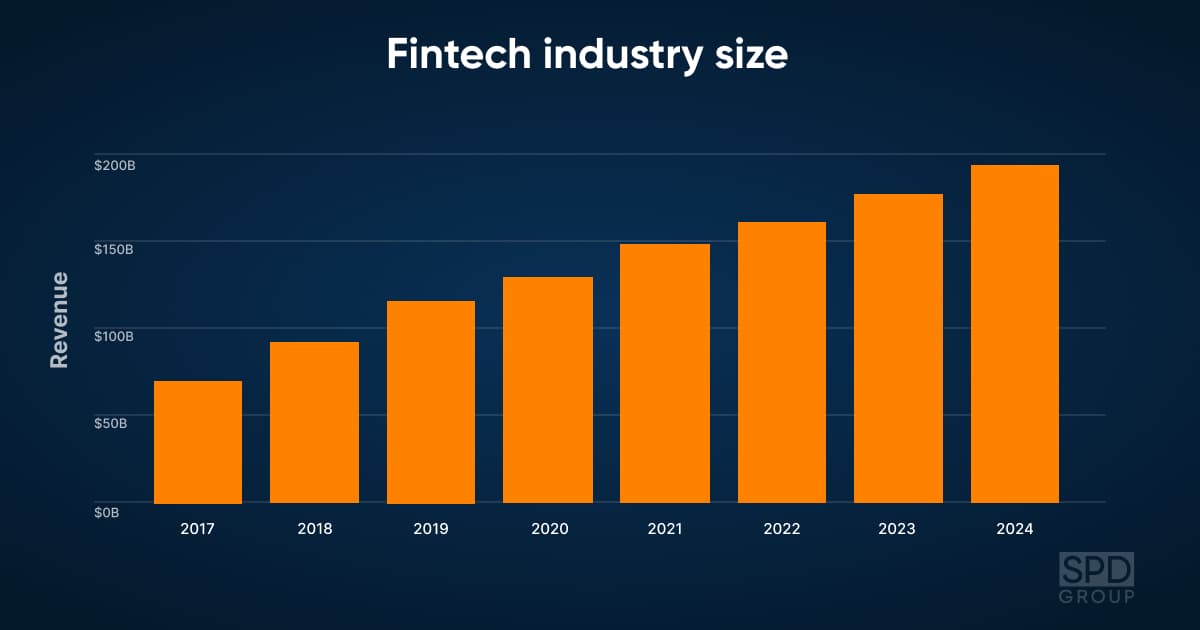

Overall, the Fintech industry has a very bright future, as fintech applications are revolutionizing the modern world. Deloitte estimates that in 2023 the Fintech industry is worth approximately $180 billion, and will have grown by $8 billion by the end of the next year.

As compared to 2017, by 2023, the size of the industry has doubled:

The global adoption rate of Fintech has exceeded 64%, and modern apps are a major part of this unprecedented growth. Among all Fintech services, payment apps are the most popular, with 70% of users leveraging them.

Fintech apps are an essential part of modern Finance right now, and every individual or organization will use them more actively in the coming years.

If you have any questions about Fintech applications, or want to build a Fintech software solution, please feel free to contact us.

Ready to speed up your Software Development?

Explore the solutions we offer to see how we can assist you!

Schedule a Call