Having an E-payment system in Ecommerce business offers convenience, global reach, instant transactions, multiple payment options, more automation, and scalability. According to Markets and Markets, the size of the Digital Payment Market is projected to grow up to $180.2 billion by the end of 2026.

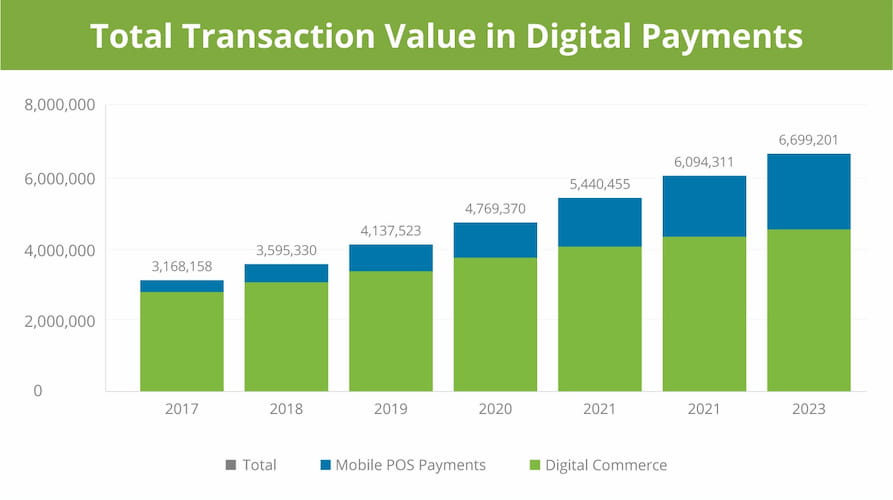

Here is some additional information from Infopulse on how the total transaction value of digital payments will grow.

To maintain buying habits in times of global inflation, people prefer the Buy Now Pay Later (BNPL) approach. Adobe claims that during the 2022 holiday’s Cyber Week (from Thanksgiving to Cyber Monday) the number of BNPL orders increased by 85% as compared to the previous week. While in 2022 the number of BNPL users was estimated at 360 million, it is expected to increase to more than 900 million in the next four years.

Additionally, there will be a rise in the popularity of digital wallets, with over a 50% leap in the next four years. So, Apple Pay and Google Pay are here to stay and will only grow this year. At the same time, we should be ready for cryptocurrencies to become even more accepted as a payment method by big brands, due to their benefits like low transaction fees, quick processing, and ease of purchase for international payment processing.

These statistics illustrate why you should pay attention to how electronic payment processing is organized in your business, and show what you can do to improve it. Let’s talk about it!

Don't have time to read?

Book a free meeting with our experts to discover how we can help you.

Book a MeetingHow the E-Payment System Can Help Your Business to Earn More

Every case is unique and outcomes can differ. However, using the best electronic payment system solution available can benefit any business to a certain extent. Here’s how:

Revenue Opportunities

This is probably the biggest point of them all — ecommerce electronic payment systems are providing customers with a variety of options to pay, which opens up more opportunities to collect revenue. The easier and more diverse purchasing options that are available, the more likely it is your revenue flow will increase.

Automated Processes

When electronic payment processing is performed automatically, there is no room for human error. It saves a lot of time and effort for the business and allows one to organize recurring payments as subscription programs.

Greater Flexibility

You can easily offer special promotions and discounts or make a quick price change in accordance with your latest marketing insights in order to make as many deals as you can.

Improved Security

At first glance, using an electronic payment system in ecommerce solutions seems like a weak point in terms of security, but you will also get access to the latest technology to protect your transactions as much as possible. Also, E-commerce fraud detection and prevention standards are very high in these systems. With the right approach and proficient ecommerce development services provider, these security technologies could serve as a cost-saver by detecting fraudulent transactions.

Engaging a New Audience

You can make your business available to a new audience by accepting payments from all over the world or by including certain E-Commerce payment methods that are popular in your target regions.

ARE YOU INTERESTED IN MARKETPLACE DEVELOPMENT?

Explore this article to find out how much does it cost to build a marketplace in 2020!

Marketplace Development6 Ways in Which E-Payment Systems Improve the Customer Experience

“Customers don’t expect you to be perfect. They do expect you to fix things when they go wrong.”

– Donald Porter, British Airways

Now, let’s take a look at the benefits from your customer’s perspective:

Simplified Process

Solutions like Amazon 1-Click Ordering, where all the customer needs to do is push one button to buy or use Apple Pay (where a smartphone needs to be placed against the sensor) create a whole new level of convenience. If your business supports these types of solutions, you will make it much easier for your customers to buy your products or services.

Eliminating Repetitiveness

If your system still requires customers to enter their personal information each time that they make a purchase, you can optimize this process. For example, by introducing an option that allows clients to save payment information and not have to re-enter it for the next order. You can also introduce the auto-pay approach the way Spotify and Amazon Prime have done, to ask your customers for the required information just once— when they get registered.

Instant Notifications

Using an electronic payment system in E-commerce allows customers to get instant notifications on whether a transaction has been completed and when they receive the products.

Minimizing Human Contact

When you set up your electronic payment system to provide a customer with all the essential functions like balance, credit information, or transaction history without the need to contact your team members, it creates an additional layer of convenience. If the customer needs to contact your business, you can launch a chatbot (a great example of using Machine Learning in Finance and E-Commerce) which is available 24/7 to show your clients how much you value their time.

Providing Various Options

This is not only a revenue driver, but also a way to improve the customer experience. Let your clients choose between credit cards, bank transactions, or maybe even cryptocurrencies and they will pay you with loyalty and respect!

Security

Having these multiple options, however, creates a problem — your business is now vulnerable to hackers. But if you use a third-party service to verify PCI compliance and make sure you are doing everything to protect customer information, you can build a reputation as a secure business. This will help build a strong brand image in the long run and make it easy for your clients to recommend your business to others because they will feel safe making purchases.

Choosing the Best Way to Integrate an E-Payment Gateway

There are three methods to integrate a payment gateway. The best fit will depend on the size of your business.

Small business owners will probably prefer the Hosted Payment Gateway method if they are fine with processing the payment externally. Like in the previous case, no PCI compliance is required, as all the processing is handled by the service provider. This method is simple and fast to integrate. However, the drawbacks here are quite significant —you can’t control a hosted gateway. To make a payment, customers must leave your website — this is not good in terms of conversion and marketing in general. Additionally, some buyers may be suspicious about going to third-party websites, which weakens your brand image.

On the other hand, integration is easy — all you need to do is add JavaScript code that will serve as your “Buy” button and direct the customer to the third-party website to make a transaction.

Businesses of any size can use the Direct Post method. After the purchase, the data instantly reaches the gateway and processor. You don’t need to have PCI compliance, because your platform will be used only for shopping, and none of the money transaction details will be on your server. With this approach, you will have room for branding and customization options. Also, a customer won’t leave your website for the purchase. The downside is that Direct Post is not the best method in terms of security. To integrate this way, the vendor must make an API connection between a payment gateway and the shopping cart on your website for transferring the information.

If you have a medium to large sized business, your brand image and user experience are crucial factors in your revenue and potential growth. That’s why the integrated method can work best here. This approach will keep your customer on your website the whole time and you will have complete control over the payment process. You will be able to adjust and customize the payment system just the way you want. The main drawback is because you need to support a payment system yourself, this could become very expensive. You will store the financial information of your customers, so you need to obtain PCI compliance to even be able to do that. If you have any custom features in mind, they may be quite difficult to implement. You need a team of experts to successfully execute the integration and add APIs to your server. While vendors offer detailed guides on this process, it is better to find the right team to perform it.

Picking the Most Suitable Electronic Payment System

Currently, there are hundreds of electronic payment solutions available for business owners. How do you decide which is the best one for your business? Here are some tips that can help you make a decision.

Learn About the Reputation

The first move is to learn about the history and reputation of a specific payment solution. With market leaders, it is quite easy, because of all the positives and negatives are simple to find. But if you need some special payment system that is not so well-known, you should spend some time reading the reviews.

Compare Fees

The pricing structure can be very different, and you should be aware of the hidden costs. Rigorously study the setup fees, monthly fees, and transaction fees to know the final price. Also, there could be some additional services or plugins that you could use in the future when you decide to grow your business.

Ensure Security

As we have discussed earlier, this is one of the most important factors for making an informed decision. The solution must ensure PCI DSS compliance to effectively protect the transaction data and customer information — this is standard. Of course, if the payment solution provider offers something else, like, for instance, Fraud Detection with ML, this is only a plus!

Make Sure the System Supports the Payment Methods You Need

Undoubtedly, there are leading payment methods like PayPal, E-wallets, or debit cards, but that doesn’t mean you should limit your business to them. Sure, your gateway must support the main payment methods available in your area. But also keep in mind your potential international growth and think about the possibility of implementing multi-currency support.

Think About Merchant Account Possibilities

A merchant account is opened with the acquiring bank the merchant wants to use for transaction processing. Some payment gateway providers offer that account as part of their service, so you should evaluate this option if you don’t already have one.

Top 5 E-Commerce Payment Systems to Choose From

Amongst the impressive variety of the available payment gateway providers, here are the five most popular options that are also available in the majority of countries.

| PayPal | Amazon Pay | Stripe | Verifone | Authorize.net | |

|---|---|---|---|---|---|

| Payment Methods | PayPal, Apple Pay, Android Pay, Venmo, Bitcoin | Amazon Pay | AliPay, Apple Pay, Android Pay, Bitcoin, WeChat, ACH, EPS | PayPal, ACH, WebMoney, Payoneer, WeChat, Wire | PayPal, Apple Pay, E-check, Visa Checkout |

| Credit/Debit Card Support | Visa, MasterCard, American Express, JCB, AMEX, Diners Club | Visa, MasterCard, American Express, JCB, Diner’s, NYCE, STAR, China Union, EuroCard | Visa, MasterCard, American Express, AMEX | Visa, MasterCard, American Express, JCB, Discover | Visa, MasterCard, American Express, JCB, Discover |

| Setup Fee | No | No | No | No | $49 |

| Monthly Fee | $30 Payments Pro | No | No | No | $25 Gateway Fee |

| Transaction Fee | 2.9% + $0.30 | 2.9% + $0.30 | 2.9% + $0.30, ACH/Bitcoin Processing 0.8% | 3.5% + 0.35% | 2.9% + $0.30 |

| Features | AVS, SSL, CCV, Virtual Terminal | AVS, SSL, CCV | AVS, SSL, CCV, Virtual Terminal | AVS, SSL, CCV | AVS, SSL, CCV, Virtual Terminal |

| Chargeback | $20 | $20 + Taxes | $15 | – | $25 |

| Number of Available Countries | 202+ | 78+ | 25 | 200+ | 20+ |

| International Transaction Fee | 3.9% + Currency-Based Fee | 3.9% + $0.30 | 3.9% + $0.30 | – | – |

PayPal

Overview of PayPal

Since its foundation in 1998, PayPal has become the most popular digital payment solution in the world with $27.5 billion in revenue in 2022, according to Business of Apps. This platform allows individuals and businesses to send and receive money electronically in a convenient and secure way.

Main Features of PayPal

The platform allows users to make online purchases from various merchants by linking their credit cards, debit cards, or bank accounts to their PayPal accounts. The main features include:

- Money transfers: Users can send money and conduct peer-to-peer transactions using their PayPal balance or linked funding sources.

Merchant services: PayPal offers integration with e-commerce platforms. - Mobile app: PayPal’s mobile app allows users to send and receive money, as well as manage their accounts.

- One Touch: This feature allows streamlining the checkout process, while enabling users to make purchases without repeatedly entering payment information.

- Currency conversion: Transactions in multiple currencies are available, as well as currency conversion services.

- PayPal Credit: Users can leverage this functionality for purchases.

The pros and cons of PayPal

Pros:

- Widespread acceptance

- Ease of use

- Advanced security measures

- International transactions

- Mobile Accessibility

Cons:

- Fees for certain transactions

- Account holds for suspicious activities and risk of account freezes

- Reported difficulties in reaching customer support

- Occasional transaction delays between PayPal and linked bank accounts

Pricing of PayPal

The pricing policies and the exact amount of fees may vary depending on the user’s location, but you should expect the following fees:

- The fees for sending money, both in the same country and internationally.

- The fees for receiving payments are typically a percentage of the transaction amount plus a fixed fee.

- The currency conversion fees are based on the current exchange rate.

- Withdrawing funds from PayPal may also incur fees, especially, for expedited transfers.

Amazon Pay

Overview of Amazon Pay

It is a digital payment service offered by Amazon. Amazon Pay enables Amazon accounts to make purchases on third-party websites, while providing a seamless and familiar checkout experience. Amazon Pay aims to not only simplify the checkout process, but also to enhance customer experience.

Main features of Amazon Pay

- Fast and secure checkout: Users can make quick purchases due to the information from their Amazon account, which includes payment methods and shipping addresses.

- Mobile-Friendly: The service is accessible from mobile devices, in addition to the desktop version.

- Payment Methods: A variety of payment methods are available, including credit and debit cards, bank accounts, and even Amazon Pay balances.

- One-Click Purchase: A similar feature to the previously mentioned PayPal’s One Touch.

- Merchant integration: Businesses can integrate Amazon Pay into their websites and apps.

- Amazon PayCode: The feature that allows customers to make cash payments for online purchases at participating retail locations.

The pros and cons of Amazon Pay

Pros:

- Convenience

- Robust security measures

- Reputable brand

- Fast buying process

- Merchant integration

Cons:

- Limited merchant adoption as compared with credit cards or PayPal.

- Fees to merchants for each transaction.

- Account dependency between Amazon and Amazon Pay accounts.

Pricing of Amazon Pay

Amazon Pay’s pricing structure can vary based on the merchant’s agreement with Amazon. In most cases, merchants are charged a processing fee for each transaction, which can include:

- Transaction fee includes a percentage of the transaction amount plus a fixed fee per transaction.

- Fees for international transactions and currencies.

- Currency conversion fees are based on the exchange rate.

Stripe

Overview of Stripe

Founded in 2010, Stripe has built its reputation thanks to developer-friendly tools and APIs that allow businesses to integrate payment processing into their websites and applications. The platform has also become popular due to its support of a wide range of online payment methods.

Main features of Stripe

- Payment processing: Businesses can securely accept payments online.

- Focus on developers: A range of APIs and developer tools simplifies the process of custom payment solutions’ integration into websites and apps.

- Recurring payments: Services and SaaS companies can benefit from subscription and recurring billing models.

- International payments: Stripe supports 135+ currencies.

- Mobile: Stripe offers mobile SDKs for businesses to accept payment within mobile apps.

- Checkout customization: Developers have tools to create customizable checkout experiences.

- Fraud prevention: Stripe has built-in fraud detection tools and a variety of security features.

- Analytics and reporting: Businesses can easily track their payment activity and performance.

The pros and cons of Stripe

Pros:

- Developer-friendly APIs and tools

- Great customization

- Global reach

- Recurring billing

- Security

- Transparent pricing

Cons:

- Possible integration complexity

- Risk of account holds

- Reported problems with customer support

Pricing of Stripe

This platform follows a transparent pay-as-you-go pricing model with some common pricing components, including:

- The transaction fees for successful transactions include a percentage of the transaction amount plus a fixed fee per transaction.

- The international fees and fees for currency conversions.

- The subscription billing models may vary depending on the chosen plan.

Verifone

Overview of Verifone

Verifone, formerly known as 2Checkout, provides a wide range of tools and services to facilitate secure and convenient online transactions for businesses of all sizes. This platform is designed to help businesses sell digital and physical goods, subscriptions, and more through various online channels.

Main features of Verifone

- Payment processing: Businesses can accept a wide range of payment methods, including credit cards, debit cards, and alternative payment options, such as PayPal and Apple Pay.

- International payments: Verifone supports transactions in multiple currencies and provides localized payment options.

- Subscription billing: Multiple subscription models are available.

- Digital content: Verifone offers features tailored for the sale and delivery of software, e-books, and digital downloads.

- Mobile friendly: Both desktop and mobile versions provide a seamless checkout experience.

- Fraud protection: The risks are minimized thanks to a variety of fraud detection and prevention tools.

- Customizable checkout: the available customization enables businesses to provide a consistent user experience across the brand.

- Reporting and analytics: Businesses are able to track sales and performance.

Pros and cons of Verifone

Pros:

- The support of international transactions and localized payment options

- Subscription billing

- Various payment methods

- Responsive checkout

- Fraud protection

Cons:

- Possible account holds

- Limited customization

Pricing of Verifone

Verifone follows a pricing model that includes transaction fees based on the type of transaction and the payment method used. Pricing may vary based on the location of the business and the type of product or service offered. Key pricing components include:

- Transaction fees are typically a percentage of the transaction amount plus a fixed fee per transaction.

- International fees may apply for international transactions or currency conversions.

- Verifone may have pricing options tailored to businesses that require subscription billing.

Overview of Authorize.net

Since 1996, this payment gateway has become a popular choice for e-commerce businesses, online retailers, and service providers. It provides tools and services that enable businesses to seamlessly integrate online payment processing into their websites and applications.

Main features of Authorize.net

- Payment processing: Enabling businesses to accept a variety of payment methods.

- Online transactions: Including secure real-time online transactions.

- Recurring payments: Both subscription and recurring billing models are available.

- Mobile payments: The platform allows businesses to accept payments from mobile devices and apps.

- Virtual terminal: Businesses are able to manually process payments and orders over the phone or in person.

- Developer-friendly: APIs and developer tools are available.

Reporting and analytics: Businesses can track payment activity and performance.

The pros and cons of Authorize.net

Pros:

- Reliability

- Wide acceptance

- Recurring billing and subscription models

- Developer tools

- Robust security

Cons:

- Complex pricing structure

- Additional costs for certain features and services.

Pricing of Authorize.net

It includes several components, and the costs can vary based on the type of business, transaction volume, and specific features used. The common pricing components include:

- Setup fee in some plans.

- The monthly fee to access the Authorize.net payment gateway.

- Fees per transaction, which typically includes a combination of a fixed fee and a percentage of the transaction amount.

- Recurring billing fees.

- Additional fees for the usage of features like fraud prevention tools or virtual terminals.

What Payment Methods Your Business Needs to Support, Depending on Your Target Location

Selling overseas might not be a priority in your strategy, but for online retailers, it’s easy to expand on the global market. Buyers tend to buy items they can’t find in their countries on international websites. Cross-border online purchases are expected to reach $1 trillion this year, so here are the most popular E-payment types your gateway needs to support in certain regions.

The United States and Canada

Cards are popular here, including Visa, American Express, Mastercard, JCB, and Discover. The most popular E-wallet service Apple Pay is a must, but you should consider other options like Android Pay and Visa Checkout. ACH Payments are exclusive to the United States and are popular there. It is also important to have a Bank Transfer option.

Latin America

Although Visa and Mastercard are widely accepted, almost half of customers prefer to buy via local cards like Diners Club or Hipercard. Speaking of E-wallets — Masterpass, PayPal, and Visa Checkout must be enough. Additionally, you must consider Local and USD Bank Transfers and the Brazil-exclusive Boleto Bancario.

Europe

For the European market, be ready to provide the most popular cards and types of E-wallets (the top gateway providers have them). But depending on the region, you must be aware of the local specifics. For example, in Germany, the most popular payment method is Giropay Bank Transfer.

Asia Pacific

The region is a giant market for those, who offer the most common card types as a payment method. In the E-wallets realm, there are two undisputed leaders — Alipay and WeChat Pay; you can’t enter the Asian market without them!

Our Experience in Implementing E-Payment Systems on a Marketplace Platform

SPD Technology has been developing and expanding a marketplace platform for more than 10 years. This marketplace platform supports more than 20 payment systems. Every payment system we have added opened up some new opportunities for sellers to acquire new clients. The platform’s smaller clients were fine with using payment solutions that existed on a platform, but the large-scale clients preferred to connect with the banks they were partnering with and wished to include their own payment methods.

The need to add some local payment methods was often a reason for the addition of a new payment system. We have experience in integrating the platform with a host of local payment systems from Denmark, the Netherlands, Poland, Greece, the United Kingdom, Norway, Spain, the Philippines, the United Arab Emirates, Canada, and the United States of America. In each case, we have dealt with different challenges while integrating the marketing platform with each of them. As an example, a Polish payment system sometimes required a significant time to accept payment because manual processing was frequently required— but we found the proper solutions for the best user experience even in such cases.

Our platform uses all three payment gateway integration methods — Direct Post, Hosted Payment Gateway method, and Integrated method for different payment systems. Sometimes, it is possible to offer the client two payment gateway integration methods for a single payment system. It was a real technical challenge to make all the possible options work properly on the platform because each of them had a different flow. Hosted Payment Gateway was the most difficult one in terms of user experience as we couldn’t control the process entirely. We had to work on those cases, when payments failed and figure out how to notify clients if payments were delayed.

3-D Secure integration was another obstacle we had to overcome. 3-D Secure is a protocol designed to provide an additional layer to the security of credit and debit card transactions online. Unfortunately, it had some major problems with the mobile user experience. When the client left our platform and moved to a 3-D Secure frame, the frame wasn’t shown correctly on mobile screens. This was an inconvenience that could negatively influence buying decisions. Besides, it also looked suspicious to the user. Although this was beyond the scope of our participation in the project, we did our best to make the 3-D Secure page look good on all mobile devices and as optimized as our platform.

So, what is the best payment system to choose?

Based on SPD Technology’s experience, it makes sense to be looking at systems that are growing at a fast pace. You can choose a well-established payment system, but if it doesn’t keep up with the innovations in the Fintech industry your business will ultimately lose customers due to some issues and the resulting customer friction in the payment process. There are a lot of convenient Fintech projects emerging on the market today that make the payment process easier and more flexible for the customer. Don’t miss out on them!

Conclusion

If your business is represented online and your goal is to earn more revenue, build a brand image, and improve the customer experience, it is worth paying attention to improving your e-commerce payment services. Using the services from payment gateway providers and adjusting them to your needs can help your business grow even in the most challenging times.

FAQ

Can I use these e-payment systems with any eCommerce platform?

Most of the e-payment systems mentioned in the article are designed to be compatible with a wide range of e-commerce platforms. However, the extent of the integration and ease of setup may vary depending on the specific platform.

Are these e-payment systems suitable for small-scale eCommerce businesses?

Yes, these e-payment systems are suitable for small-scale e-commerce businesses. Most of these payment systems are designed to cater to businesses of various sizes, including small and medium-sized enterprises (SMEs).

How do e-payment systems ensure the security of customer transactions?

There are multiple approaches to this, including encryption, tokenization, Secure Sockets Layer (SSL) and Transport Layer Security (TLS), Two-Factor Authentication (2FA) and PCI DSS Compliance.

Further Reading

- 7 Top Ecommerce Payment Gateways

- Overview of Payment Processing

- The emergence of Payment Systems in the Age of Electronic Commerce

- 7 Electronic Payment Systems

Ready to speed up your Software Development?

Explore the solutions we offer to see how we can assist you!

Schedule a Call