Summary

Industry: FinTech

Location: Headquarters in Palo Alto, CA, the U.S.

Partnership period: 18 months.

Size of the project team: 30+ experts.

Software product: AccountingSync, E-commerce, Virtual Terminal, Physical Terminal Software, Invoices, Card-on-File, Recurring Payments, Loyalty, Messaging, Advanced Register.

Expertise delivered: Custom Software Development, software support, maintenance, brand-new features/improvements, eCommerce, and Payments-related industry expertise.

Challenge

At the time they approached us for assistance, our Palo Alto, CA-based client Poynt was a rapidly developing hi-tech startup. They were backed by prominent banking institutions, investment funds, and technology vendors that included Elavon, Google Ventures, Matrix Partners, National Australia Bank, NYCA Partners, Oak HC/FT Partners, Stanford-StartX Fund, and Webb Investment Network.

The company was on the lookout for a reliable software development partner to help them further develop their mission-critical Omnicommerce platform. In 2019, Poynt approached SPD Technology through a referral by a high-ranking executive of an eCommerce client of ours.

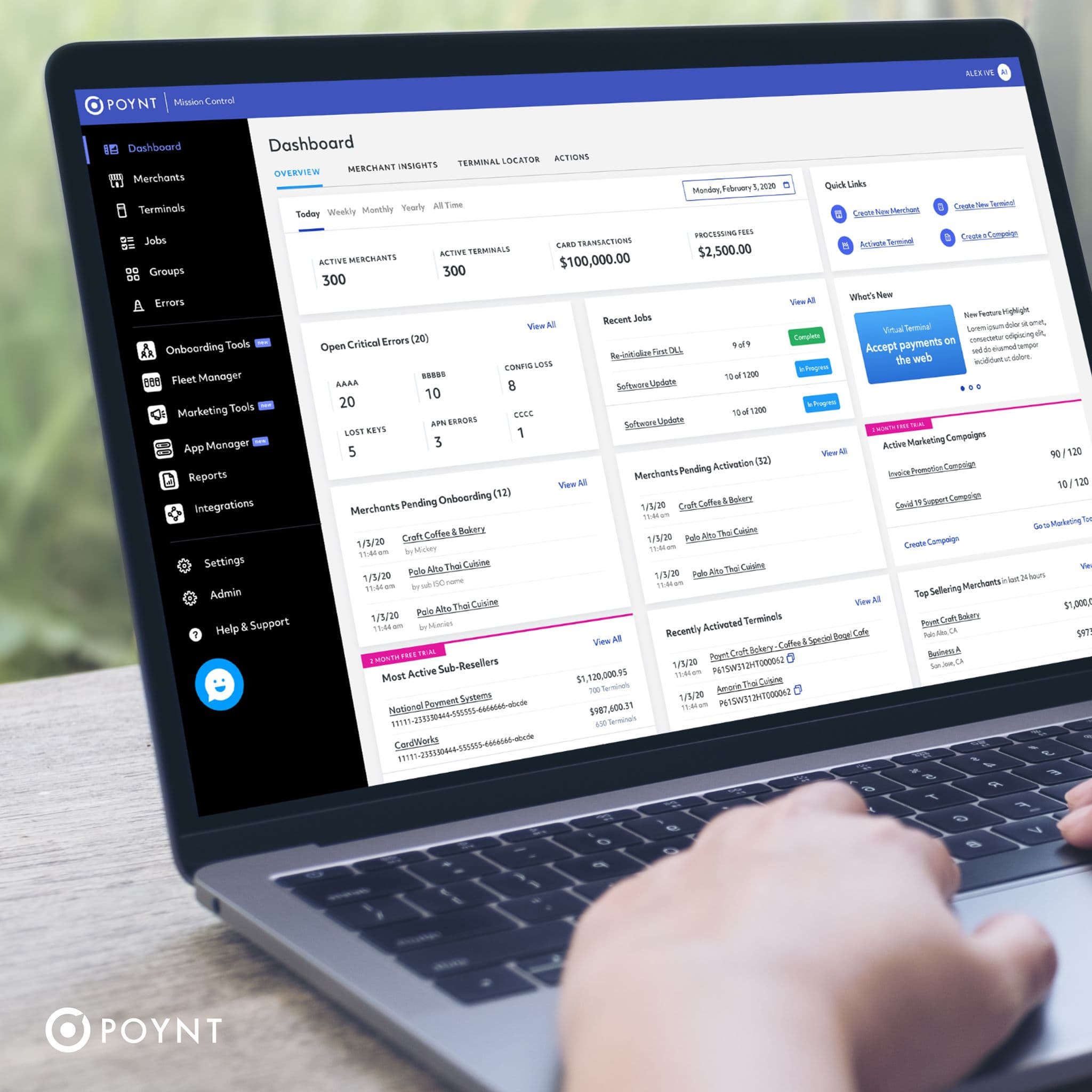

The Client’s Product

The client’s platform is an innovative all-in-one commerce solution. The solution comprises both software and hardware, developed and produced entirely by the client. More specifically, the solution is composed of:

- Any of a range of devices, from a simple card reader to the Poynt Smart Terminal.

- Poynt OS (a powerful Android-based operating system).

- Poynt Cloud (a set of cloud-enabled software).

- Payment processing functionality.

- Onboarding and underwriting functional capabilities.

- Instant funding functionality.

- A selection of merchant type-specific, tailorable payment terminal software bundles.

Initially, at the core of the Poynt platform was the Smart Terminal. This easy-to-use payment terminal enables various mid-sized and small merchants to conduct business in a hassle-free manner by allowing them to accept and quickly process payments. The solution expedites payment processing. It eliminates any payment-related delays that can be especially financially cumbersome for small merchants.

However, as Poynt’s solution evolved, the focus shifted to its more advanced functional capabilities, like, for example, the payment facilitation functionality that includes merchant and transaction risk management. These capabilities gradually became the system’s most popular and frequently used functionality.

The Admin module of the client’s platform allows a merchant’s employees to easily view sales history, identify fraud transactions, determine the types of the credit cards used to make the transactions, identify frequent customers for marketing purposes, and more.

The solution’s Risk Management module provides intricate functionality for advanced customer risk evaluation. One of the solution’s more significant features is the possibility to use a debit card. Merchants can significantly reduce their processing rate by transferring funds to a Poynt-issued debit card. This feature creates a significant competitive advantage for Poynt.

The platform supports integration with a wide array of peripherals that include printers, scanners, cash drawers, and more.

Poynt engaged SPD Technology to both help develop their platform’s key functions and support the creation of business niche-related customizations for their reseller partners.

Solution

To start implementing the project, we initially allocated a total of 4 experts. These experts became part of the client’s different in-house development teams. Within the following half a year, our involvement in the project had grown to a total of 30+ software developers and other experts. Thus, SPD Technology became Poynt’s primary technology partner.

Gradually, the engagement model of our project involvement transformed from that of Staff Augmentation to 8 full-value, cross-functional dedicated development teams. Each of these teams assumed full responsibility for the deliverables in one of the areas of the client’s product. Furthermore, our software architects became involved in the project too and designed the vast bulk of the solution’s complex functionality.

Our project teams have encountered numerous challenges while implementing the project. Ensuring the high quality of the deliverables in the project’s largely startup environment took us an additional effort, just like the need to shift to the Dedicated Development Team model for greater efficiency.

Interactions-wise, our experts interacted with a diverse array of project actors on the client’s side. These project actors included their Engineering Managers, Product Managers, and various business stakeholders, who were responsible for the different parts of the client’s platform. Furthermore, we also closely interacted with the client’s business partners and customers. For instance, our experts extensively interacted with a banking institution Poynt’s solution was integrated with.

Several areas of the solution’s functionality posed significant development challenges, as they required a very high level of some niche industry expertise. For example, the system’s complex and intricate risk management functionality proved to be extremely challenging to develop.

In some cases, like in the case of eCommerce or FinTech capabilities, we had an exceeding amount of the corresponding industry expertise from our previous projects. In others, our developers had to promptly gain a sufficient level of the required expertise additionally. Some of the niche expertise we were dealing with significantly increased the time required by software developers to get a handle on the corresponding functionality and achieve the required efficiency. As an example, in the case of mobile developers, this period could constitute several months.

Quite frequently, our company’s software developers had to deal with legacy code that was a few years old. They had to improve this legacy code, or shift to later frameworks.

Despite these and other challenges and hurdles, SPD Technology’s project teams delivered the bulk of the client’s platform’s core functionality in fine quality, on time, and on budget.

Don't have time to read?

Book a free meeting with our experts to discover how we can help you.

Book a MeetingTechnical Solution

SPD Technology’s project team has used the following tech stack to implement the project:

Front-end

- Ember.js

- React

- Vue.js

- Express.js

Back-end

- Java 8

- Spring

- Spring Boot

- MySQL

- Redis

- Elastic Search

- Kafka

- Couchbase

- Hibernate

- Querydsl

- Junit/Mockito

- Postman

- Google Guice

- Node.js

Testing

- Cypress

The biggest challenge SPD Technology’s experts have come across was the need to transition to a more recent version of the DB server to allow handling more traffic and reduce the amount of the required storage space on the Amazon servers.

Almost all Poynt’s servers were located on Amazon and ran on an older version of the DB server as far as the database-related operations were concerned. Furthermore, the older version of the server had some major issues related to the partitioned tables. Our experts decided to make the main transaction tables partitioned in order to be able to archive whole partitions, move them to an external storage, and thus reduce the DB’s volume.

Therefore, we decided to migrate all Poynt’s projects to a new version of the DB server. To enable copying data from the ordinary tables to the partitioned ones, our engineers created a custom tool.

We successfully completed the migration and achieved all its goals. Partitioning the transaction tables took us around a year and was completed in July of 2020.

The Poynt platform’s complex risk management functionality constituted a formidable development challenge too.

This multilayer functionality provides risk evaluation for both merchants and transactions. Every time a transaction or merchant is onboarded, this triggers multiple, sophisticated interdependent calculations that use intricate algorithms. To evaluate merchants and transactions, the functionality also interacts with multiple external sources.

Development errors, imprecision, or malfunctions in this area of the client’s system could easily result in significant financial losses. All this made implementing the risk management functionality of the Poynt platform extremely demanding from the technical perspective.

Result

Our involvement in implementing Poynt’s mission-critical project has been instrumental to its success.

SPD Technology developed the bulk of the core functionality of Poynt’s omnicommerce platform, completing its delivery in 2021 and living up to all the client’s expectations.

Relatively soon after the platform’s launch, the number of merchants that used the Poynt platform had reached thousands. The solution kept rapidly gaining in popularity and started drawing a great deal of interest on the part of major market players, including both larger-size merchants and potential integration partners in the Financial Services industry.

In February of 2021, the Poynt project was acquired by GoDaddy (NYSE: GDDY), a $14B company.

Ready to speed up your Software Development?

Explore the solutions we offer to see how we can assist you!

Schedule a Call